Regulatory Information Energy CNMC

The remuneration model of the electricity market in Spain requires companies engaged in the distribution of electricity to provide a large amount of information to the CNMC about their investments and electricity grids with a level of detail that is hardly available in business management systems of distribution.

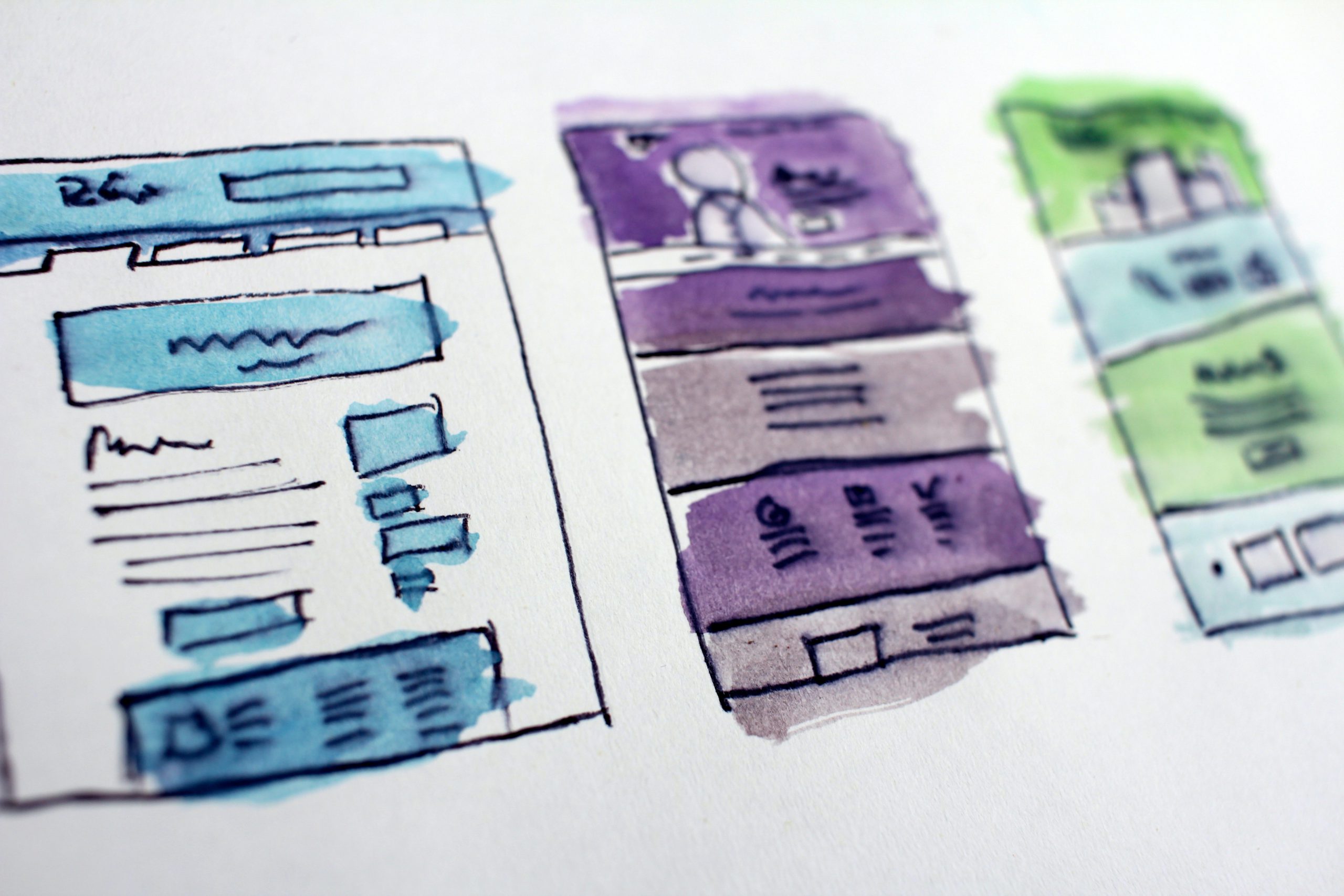

A system capable of communicating with the different data sources in order to obtain all the necessary information for the preparation of the reports that the different distributors have to present annually to the regulatory body regarding their expenses and investments made, has been developed.

The main processes that make up this system in charge of preparing and presenting information to the regulatory agency are:

- Investments: process that contains all the economic and technical information, as well as the time dedicated to the work, necessary to relate the investments made with the corresponding facilities.

- Consistencies: analysis process that guarantees that the information is valid to be presented correctly in the different reports.

- Inventory: process that contains all the information related to each of the facilities.

- Loading information and Master Data: processes responsible for transferring all the information from the source systems and their respective configurations necessary to adapt the data to the criteria of current legislation.

SUCCESS STORIES